Start

Need to Register your business?

Start Here!

If your business will operate as a sole proprietorship or a general partnership, you should file an “Assumed Name Certificate”, also known as a DBA (stands for “doing business as”), for each name the business uses in commerce. The form is filed with the county clerk in each county where a business premise is maintained. If no business premise is maintained, it should be filed in each county where business will be conducted.

If your business will operate as a corporation, limited partnership, or limited liability company (LLC) you will need to register with the Secretary of State through their SOS Direct. If this entity also operates under a name other than the name on file with the Secretary of State, an Assumed Name Certificate must be filed with the Secretary of State. Forms can be found HERE.

Effective January 1, 2022, the Texas Secretary of State will waive all filing fees for new veteran-owned businesses. This provision expires December 31st, 2025. New veteran-owned businesses are also exempt from paying franchise taxes through the Texas Comptroller's Office from January 1, 2022 through January 1, 2027.

SOS FAQ

Please Note – Neither the filing of an Assumed Name Certificate nor the reservation or registration of a company name imparts any real protection to the party filing the certificate. It is merely a formal process that informs the general public of the registered agent for a business and where official contact with the business can be made. In case of a name dispute, it can be used as legal evidence in litigation.

Basic steps for Starting a Business in Texas

Click anything on this list to be taken to that portion of the page.

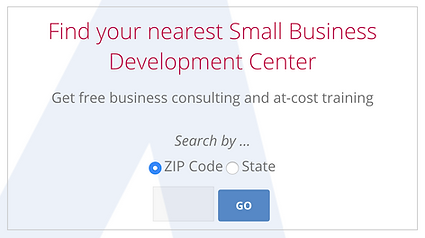

Your local ASBDC can help you file an Assumed Name Certificate, also known as a “DBA” (Doing Business As) anywhere in Texas. If you’re not in Texas your local office can assist you with filing your business in your state.

If you need assistance filling out any of these forms or have other questions, please contact your local ASBDC.